Introduction

PayPal is charging hard into the online invoicing space and company owners, entrepreneurs, freelancers, and self-employed professionals are the lucky beneficiaries.

According to statistics compiled by enterprise cloud services giant Salesforce.com, almost 50% of all American B2B companies offered their full product catalog online in 2018, a trend that is expected to grow significantly over the next few years.

And retailers are hardly the only ones taking their operations to the internet; the world of e-commerce is no longer considered to be the sole purview of online shops because all other commercial and professional sectors are augmenting their online presence.

PayPal Invoicing for WordPress

Are you using WordPress? Would you like to create PayPal invoices from directly within your WordPress or WooCommerce dashboard? Install our FREE PayPal Invoicing for WordPress plugin today!

Saved from Invoicing Purgatory

The invoicing process used to be a concern for companies and individuals taking their businesses online, due to the lack of easy solutions, but this is no longer the case thanks to PayPal. Say a new attorney gains admission to the Missouri Bar and decides to go into solo practice. As soon as she registers her law firm and obtains the adequate taxpayer identification number, she can easily sign up for a PayPal business account to start creating and sending online invoices.

This type of account, also known as a merchant account, enables more than just PayPal payments. It also accepts credit and debit cards from major networks such as Visa, MasterCard, Discover, American Express, and Diners Club. In the future, PayPal may even accept major cryptocurrencies, but this is still in the works.

PayPal has truly brought online invoicing to the masses, though there is even more to this service than billing. To understand how PayPal invoicing can boost your online business, it helps to learn some of its interesting features and integrations.

How PayPal Invoicing Works

As mentioned, getting started is a simple matter of setting up a PayPal Business account with the right taxpayer identification number, which will be verified. Something worth mentioning in this regard is that individuals or companies using their employer identification number (EIN) can use PayPal invoicing to pay their subcontractors, but not their employees. There is a Mass Pay feature that can be used for payroll purposes, but it is separate from invoicing.

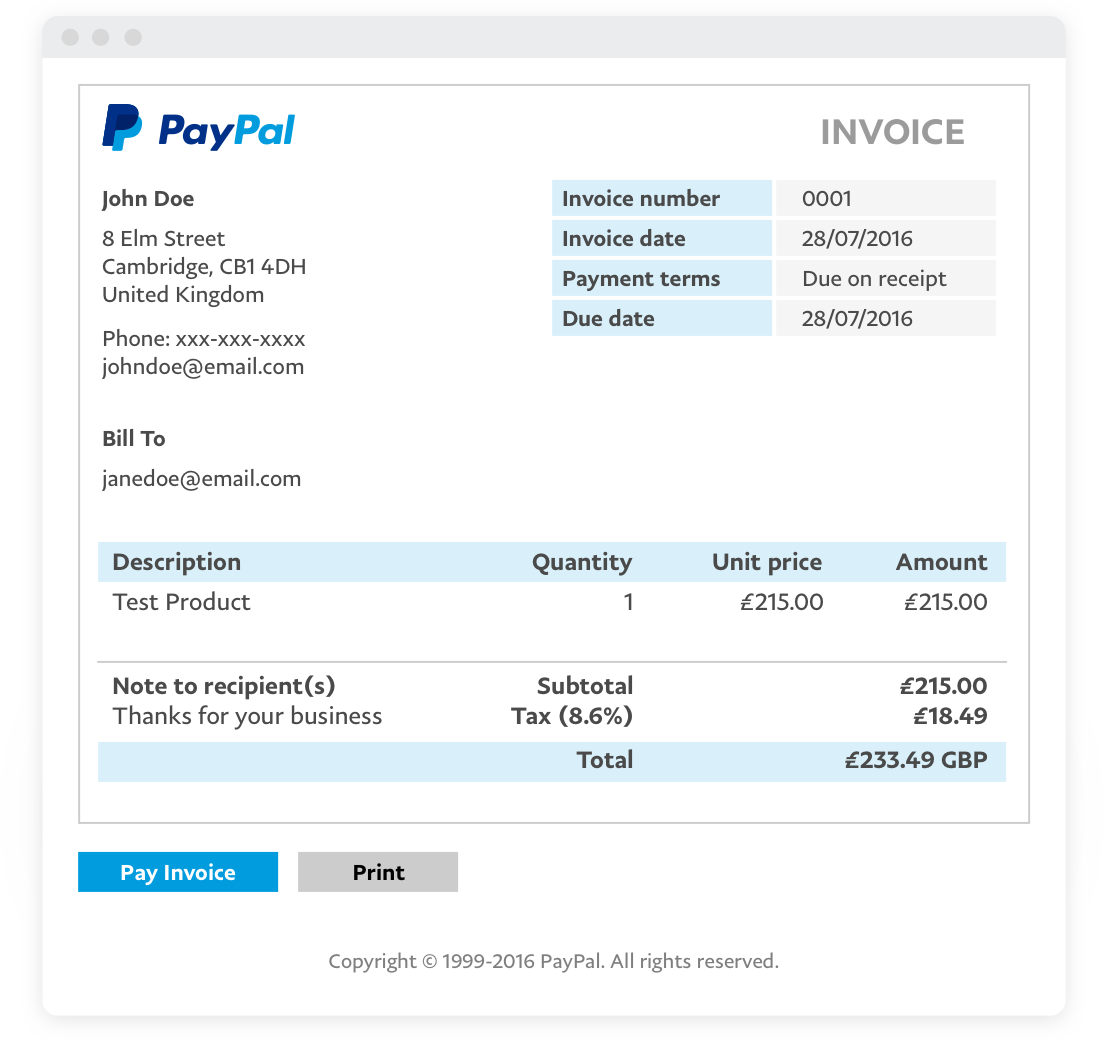

PayPal invoices can be created and sent from just about any internet-connected device, which includes desktops, laptops, tablets, and smartphones. In essence, the invoice created is sent as a link via email, but can also be shared via mobile text messaging, internet chat or social networks. As long as both parties are responsive, the entire process of sending out an invoice and receiving payment can take just a few minutes. Customizing invoice templates with company logos, slogans and customer service phone numbers is highly recommended.

Once a payment is made, PayPal sends a notification and credits the money to the account. If a PayPal Business Debit Card is on file, it can be used for purchases or to instantly access funds from automated teller machines. The invoice creation process is intuitive, thanks to existing templates that can be customized and saved so that certain items such as customer information, taxation rates, and descriptions can be used again.

Sequential invoice numbering is automated, but it can also be customized.

Managing Invoice Reminders

The convenience afforded by the PayPal invoicing system extends to the speed of payments. As long as both parties are on the same page, transactions can be settled in minutes, but what about past due invoices? PayPal makes it easy to send out reminders through the Manage Invoices section, which can be accessed from the Tools option of the top menu bar. Reminder messages can be personalized, but the default language offered by PayPal is succinct enough.

As you may know from your own online buying experience, a persistent reminder process is key to the vendor eventually getting paid in full. The problem is the human attention span has suffered a four-second drop between 2000 and 2017 and now stands at 8 seconds. That number clocks in at less than a goldfish, which logs a 9-second persistence of focus. Humans pay less attention than goldfish. If ever there was an argument to be made for staying on top of the invoice reminder process, this is it.

PayPal Invoices Paid With Checks

Despite the digital payments revolution, commercial checking accounts are still being used in the United States, making it one of the few countries where companies continue to use this payment method even though it’s three centuries old.

The U.S. Treasury still uses checks, and the same can be said about quite a few banks and companies, large and small. In fact, the Federal Reserve reported $28 billion paid by checks as recently as 2015. When a PayPal invoice is paid by check, the money bypasses the PayPal account, but the system offers the option of recording the payment for accounting purposes

Accepting Partial Payments

Business owners are free to accept partial payments or deposits when they issue PayPal invoices. The bottom left section of the invoice creation screen offers the option to allow partial payments, and minimum amounts can also be specified. Clients can always choose to pay the minimum, more than the minimum or the full invoice at any time during the billing period.

A partial payment status will be correctly and automatically displayed on the invoice, and reminders sent out with the correct balance. Freelancers who enable this feature are sometimes surprised to get tips from clients who appreciate the gesture.

Tracking Invoice Activity

PayPal offers a complete history of each invoice sent and all payments received, including checks, partial payments, past-due situations, tips, taxes collected, and delivery failures.

PayPal Invoicing Integrations

Once a business starts issuing more than a handful of invoices per day, integration options offered by certified PayPal developers are worth consideration. E-commerce solutions for WordPress, WooCommerce, FileMaker, and PHP can greatly enhance the PayPal invoicing process and make it more efficient.

Some solutions are available as free plugins, but if you intend to use PayPal, it’s a good idea to retain the services of a certified PayPal developer to make sure you don’t encounter integration issues.

The Bottom Line

Ultimately, anyone who chooses to offer products or services online can benefit from using PayPal invoicing. PayPal is a proven way to power an e-commerce store, particularly if you are just getting started with online payments. You also should be aware of the billing on the go service, which means that you can bill clients or keep track of your invoices from your smartphone even when you are not in the office.

Looking for Live Help?

Schedule a live meeting with Drew Angell, PayPal Certified Developer, and get all of your questions or concerns answered.

Featured PayPal Products and Services

-

PayPal Support

$100.00 -

PayPal for WooCommerce

FREE! -

WooCommerce Multiple PayPal Accounts Plugin

FREE! -

PayPal Shipment Tracking for WooCommerce

$49.99 -

Offers for WooCommerce

$59.99 -

WordPress PayPal Invoice Plugin

$20.00 -

PayPal Webhooks for WordPress

$79.99 -

Sale!

PayPal IPN for WordPress

Original price was: $59.99.$49.99Current price is: $49.99.