Introduction to How Does PayPal Work?

From Pony Express to telegraph transfers and fast wired transactions, people have always managed to find a way to transfer goods both nationally and internationally. However, the digital revolution has opened new doors to new ways of sending and receiving money. As a result, the Internet has seen the rise in the number of numerous payment solutions that ensure fast and secure money transfer.

As the Web has grown, some of those gateways have become more popular than the others. PayPal is definitely one of those solutions that have gone ahead of the curve. More than 200 million active PayPal accounts are the best proof of the quality this money-transfer system has reached. The aim of this article is to explain what makes PayPal the most widespread payment solution and how various users can benefit from it. We’ll do our best to answer a very broad question; how does PayPal work?

Registration and Initiation

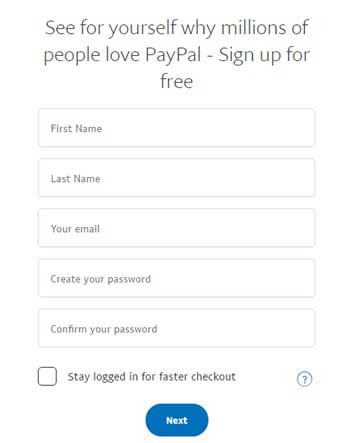

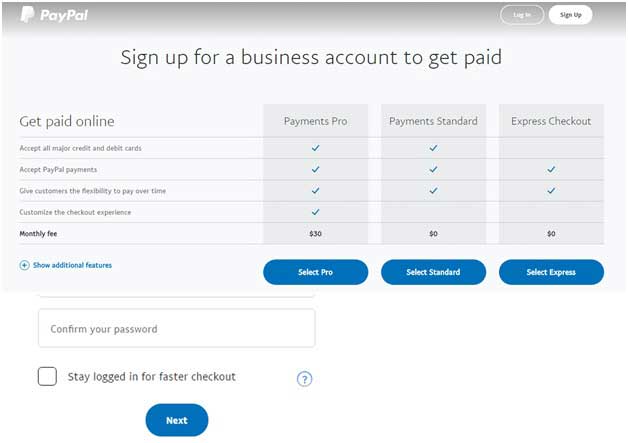

The general process of registration and initiation is pretty straightforward. First and foremost, go to the PayPal homepage and click the Sign Up button. Having done this action, you’ll be offered to set up a personal or a business account. If you choose to open a personal account, you’ll have to enter the personal information, as required in the following screenshot.

Bonus Tip!

If you are using any of our PayPal tools we can get you a PayPal Pro account with no monthly fee! Contact us for details.

Once you’ve filled out all the forms, you’ll get a confirmation link on your email address. Also, this address is one of the key features for the smooth use of PayPal, since you’ll be asked to enter it for every single transaction. Therefore, make sure that you register here with a valid email address that you check daily.

Multiple Account Numbers and Limitations

PayPal offers a variety of options, accounts-wise. That way, you’ll set one of your bank accounts or credit cards as the primary source for your PayPal transactions. When you make an online purchase, that primary account will be charged for the given transaction.

Apart from that, you can add several other monetary sources, such as additional bank accounts, credit cards, or debit cards. In case the funds from the primary source don’t suffice for a transaction, you can allocate money from these additional sources.

Since every business transaction includes invoices and estimates, you can integrate your invoicing software with your PayPal account.

However, bear in mind that the room for maneuver is limited for the owners of personal accounts. For instance, you can freely send and receive assets via this account, i.e. you can send funds to your friends or associates in 55 countries. Here you can check what countries are eligible for sending and receiving money via PayPal.

Conversely, if you want to accept a payment, it can be done only from another PayPal account. Neither debit card nor credit card payments are possible in that case. Also, there’s a limit when it comes to the amount of money you can receive on your personal PayPal account.

Fast Track to Sending Money

Now that you’ve populated your account list, it’s time to learn the next step, how does PayPal work when sending money? Here’s what you need to do:

- Login to your PayPal account.

- Go to the Send money option on the PayPal homepage.

- Enter the recipient’s email address into the proper space in the form (of course, the recipient also needs to be a registered PayPal user).

- Write all the information related to that transaction.

- Follow the steps to complete the process of sending money to your recipient.

It’s important to know that no private banking data of yours will be visible to the recipient. This is extremely important for people who want to make online purchases because your personal information will be safe during these procedures.

Expenses and Fees

One of the reasons why PayPal is gladly used by millions of people globally is the fact that they (PayPal, not people) don’t charge any expenses upfront. Nevertheless, every middleman service needs to charge some parts of their work, so as to manage to survive and ensure reliable services. So, PayPal users have to pay a certain fee for every transaction they make. The chart below shows the fees and the transaction price ranges.

| Money transfers | Fees |

| 1) Below $3,000 | $0.30 + 2.9% of the total sum |

| 2) $3,000.01 – $10,0000 | $0.30 + 2.5% |

| 3) $10,000.01 – $100,000 | $0.30 + 2.2% |

| 4) $100,000.01 and more | $0.30 + 1.9% |

Also, here’s a friendly tip for newbies to the PayPal system – when selling something on the Web and receiving money via PayPal, make sure to account for the transaction fees in your projections so that you can price your products to reach your planned profit margins.

Caveats

Despite being the greatest paying platform on a global scale, PayPal still suffers from some unexpected issues. For instance, if you keep the money on your PayPal or credit card account in one currency and make a payment in another one, the exchange rates are pretty high – you’ll be charged additional 2% of the paid sum for the conversion. To avoid this, make sure to configure multiple foreign currencies within your PayPal account.

Moreover, the highly protective security measures exercised by PayPal can be problematic at times, especially when you have a brand new account. You may be asked to provide multiple forms of ID, address verification, etc. at some point. As long as you provide the documentation they request this can be resolved very quickly and easily.

You also want to be sure to follow a few standard procedures when selling online and receiving payments with PayPal (or any payment processor for that matter.)

- Never ship to an address that does not match the address on the buyer’s credit card. PayPal calls this a “Confirmed Address” and the address would be a Full Match on any credit card verification details.

- Always ship using trackable service providers so that you can prove your item was delivered.

- Require a signature on orders that are $200 or higher.

- Include insurance on shipped products.

Following these basic steps can keep you from running into major problems when selling online.

Modern people like to make a payment or send/receive money as soon as possible. Luckily, the digital world of today gives us numerous opportunities to perform these actions with a few clicks of a computer mouse. In this online environment, PayPal deserves your attention. This solution will enable you to transfer money in the shortest time possible, via a reliable, highly secure and affordable transferring platform.

Author Bio

Mark Thomasson

Mark is a biz-dev hero at Invoicebus – a simple invoicing service that gets your invoices paid faster. He passionately blogs on topics that help small biz owners succeed in their business. He is also a lifelong learner who practices mindfulness and enjoys long walks in nature more than anything else.

Featured PayPal Products and Services

-

PayPal Support

$150.00 -

PayPal for WooCommerce

FREE! -

WooCommerce Multiple PayPal Accounts Plugin

FREE! -

PayPal Shipment Tracking for WooCommerce

$49.99 -

Offers for WooCommerce

$59.99 -

WordPress PayPal Invoice Plugin

$20.00 -

PayPal Webhooks for WordPress

$79.99 -

Sale!

PayPal IPN for WordPress

Original price was: $59.99.$49.99Current price is: $49.99.