Introduction

There has been a lot of discussion lately about the new PayPal Refund Fee policy updates they are announcing. Basically, PayPal will no longer be refunding the fee from initial payments when you refund your buyer.

Many sellers are complaining loudly about this change, but is it warranted?

I’m going to break down all of the details of exactly what is happening here, and why I feel people are making a much bigger deal out of this than they should.

Then we’ll discuss the best procedures to follow so that you can avoid these unnecessary fees.

Video

PayPal Fee

When you accept a payment using PayPal (or any other payment processor) you are charged a fee for processing the transaction. This is a standard procedure with all payment processors.

PayPal’s fee structure starts at 2.9% + .30 USD. As you process higher volume the fee structure is reduced, but we will stick with the initial rate for this example.

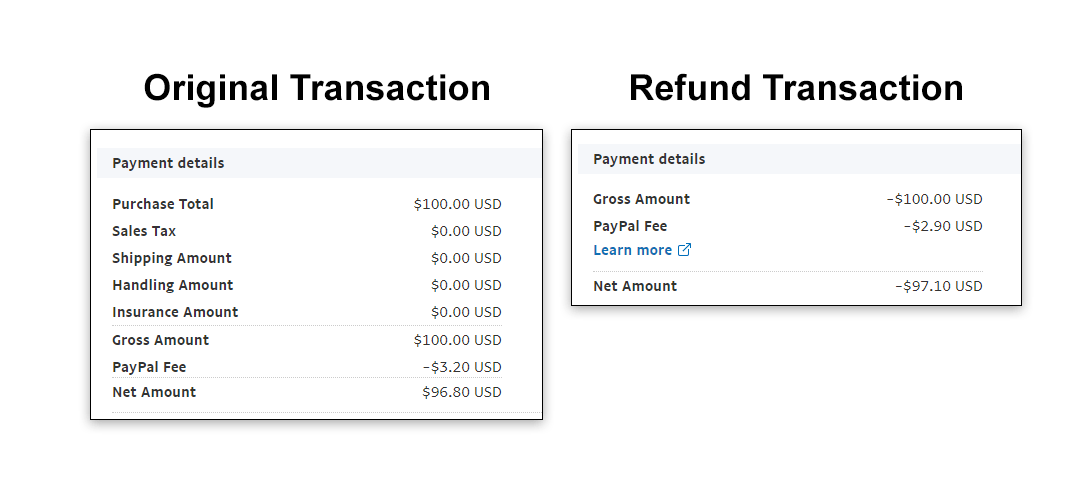

If you sell a product for $100 you would be charged a total fee of $3.20 broken down as follows:

- Percentage Based Processing Fee = 100 * .029 = $2.90

- Flat Rate Transaction Fee = .30

- Total Fee = $3.20

Check out this PayPal fee calculator to simplify the math for you!

Refunds

If you have to refund your buyer for any reason, you would typically process a refund from the original transaction in your PayPal account.

When you do this, the original processing fee you paid of 2.9% is currently (as of September, 2019) refunded back to you. This amount is then included in the funds that get returned to the buyer. The .30 transaction fee is not refunded.

Example

You can see in the refund transaction that PayPal returned the $2.90 payment fee back to the seller. The net amount returned to the buyer is $97.10. This is something that PayPal has always done even though it does not follow the industry standard.

This has been a nice perk that PayPal merchants have enjoyed for many years. Unfortunately, it caused sellers and marketplace providers to get a little bit lazy with their payment integration. There are things sellers can do to avoid refunds, but this was not happening. As such, PayPal had to make a change.

New Fee Refund Policy

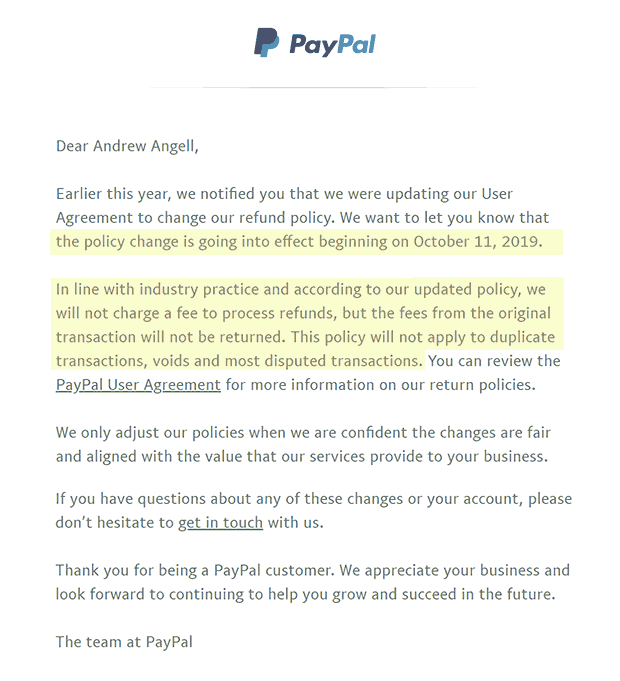

PayPal has begun sending all account holders an email notifying users about this policy update. Here is the copy I received.

PayPal Notice About Fee Refunds

The policy change is going into effect beginning on October 11, 2019.

In line with industry practice and according to our updated policy, we will not charge a fee to process refunds, but the fees from the original transaction will not be returned.

This policy will not apply to duplicate transactions, voids and most disputed transactions.

This policy change was originally announced to go into effect in May, 2019. However, it seems that the community backlash and confusion caused a delay.

As mentioned, it is now officially going into effect on 10/11/19. As such, the community backlash has picked up again.

Community Backlash

This has caused quite a backlash in the community, and people on Twitter, Facebook, Reddit, and PayPal’s direct community are making it known that they are not happy.

PSA: Paypal will no longer return processing fees (2.9% + $0.30) when you refund a customer starting October 11, 2019.

After walking back the decision in May due to outrage, Paypal is now moving forward anyway and hoping you don’t notice.

Nail in the coffin. Goodbye, @PayPal. pic.twitter.com/sAweMHxtLn

— Sean McCabe (@seanwes) September 19, 2019

Big mistake @paypal. Policy change will strangle your business customers. “In line with industry practice and according to our updated policy, we will not charge a fee to process refunds, but the fees from the original transaction will not be returned.” #SmallBusiness #CheckOut — Tony L (@Bennylux1) September 18, 2019

@paypal is going to enact their “steal your money fee” They will no longer refund your transaction costs. They already steal .30 on every refund anyways. — SAVANTone (@pcsavants) September 18, 2019

I started to sell on eBay and other online stores about a year ago and had no real issues doing business. Until PayPal decided to not refund sellers the 2.9% transaction fee. I will now close my Paypal account and never use this service again. #Paypal #eBay — The Garage Depot (@TheGarageDepot) September 20, 2019

People need to stop using @PayPal this come on 10/11/2019 will stop refunding merchants fees, so what this means is when you refund a customer their money PayPal will keep your fee. @paypal is just one of many merchants that you can use. Let’s show this company!!! #paypalsucks

— Navy Veteran (@bicharlie0712) September 20, 2019

Is this Really an Industry Standard as PayPal Claims?

The email that PayPal sent states that this change is “In line with industry practice.” Is this true? Let’s actually take a look at some and see how they compare.

Adyen Payments

Adyen is the payment processor that eBay is switching to after moving away from PayPal.

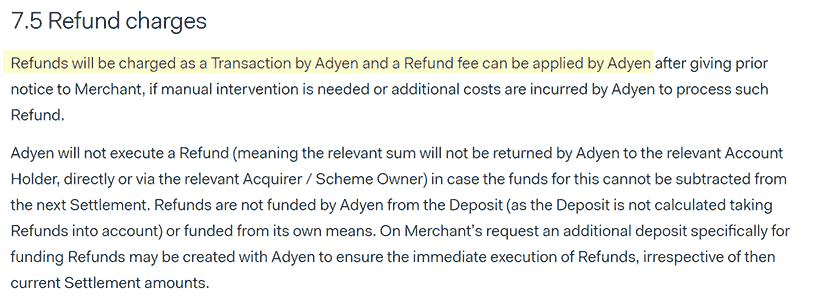

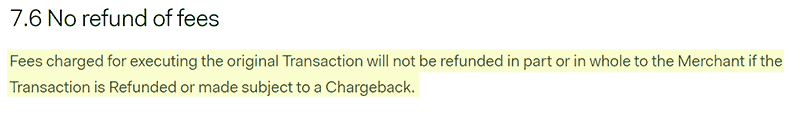

Let’s go ahead and take a quick look at Section 7.5 and Section 7.6 of the Adyen Terms and Conditions:

Adyen Refund Policy Section 7.5

Refunds will be charged as a Transaction by Adyen and a Refund fee can be applied by Adyen after giving prior notice to Merchant…

This states that Adyen will actually charge an additional transaction fee for processing the refund transaction.

Remember, PayPal says they will not charge an additional transaction fee for the refund, but they simply are not refunding the processing fee.

Adyen Refund Policy Section 7.6

Fees charged for executing the original Transaction will not be refunded in part or in whole to the Merchant…

This states that Adyen will not refund the original processing fee, just like PayPal will now be doing.

So when compared, PayPal actually comes out better than Adyen because they will not charge an additional transaction fee for processing the refund.

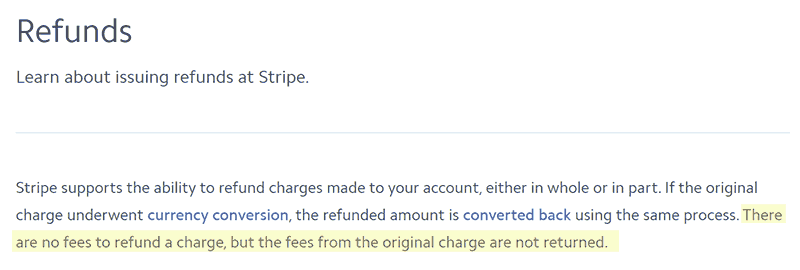

Stripe Payments

Stripe is another popular payment processor that many people are making blind claims about, thinking that moving from PayPal to Stripe will allow refunding of fees. Once again, let’s review their documentation on refunds:

Stripe Refund Fee Policy

There are no fees to refund a charge, but the fees from the original charge are not returned.

That sounds familiar. It’s exactly what PayPal is saying about their fees now. So this is the same as well.

Others

If you shop around, you will see that the vast majority of payment processors follow this practice. It is indeed true that PayPal is making this move in line with the industry standard.

Is PayPal “Stealing” or “Being Greedy”?

Many are making claims that PayPal is stealing their money by keeping fees when they process refunds. Others are claiming that PayPal is just being greedy. Really? How exactly is this, I would ask..?? You did use PayPal’s service exactly as advertised, right?

They provided their service for you to process the order payment quickly, easily, and securely.

Then, when your buyer wanted a refund for one reason or another, they processed that refund for you quickly, easily, and securely.

You could have used cash or check, mailed envelopes and purchased stamps, waited on time in the mail, deposit check at the bank and wait on it to clear. Then, for the refund, you would have to repeat that process over again.

Instead, you used a payment processing service (again, they all work this same way) and they charged you for using their service. Is it their fault your customer wanted a refund?

Why should they have to eat the cost of the resources involved with processing millions of refund transactions because sellers aren’t following proper procedures to avoid them?

If You Are Upset, Why Are You Processing So Many Refunds?

The primary reason people are upset about is, well…money. When you hear that your fees will no longer be refunded, you instantly consider that this will result in lost profit due to increased expenses.

Of course, this is true…if you are processing lots of refunds. If this policy change is a problem for you, my question then would be “why are you processing so many refunds?”

When I ask this question I almost always get some form of the following replies:

I am selling on eBay, and I get lots of orders where the buyer cancels before I ship the product.

I have good product descriptions and pictures, but buyers do not read well, and it’s too easy for them to file and win disputes.

Understandably, this could be extremely frustrating. Especially if your are selling high dollar items and this is happening often.

Is this really PayPal’s fault, though? Or any payment processor, for that matter? Let’s review some details of how we might help ourselves avoid this problem.

How to Avoid PayPal Fees from Refunds

Regardless of how you feel about this policy change, and whether or not you will be continuing to use PayPal or not, there are things you should do to protect yourself from paying unnecessary fees related to refunds.

Authorization and Capture

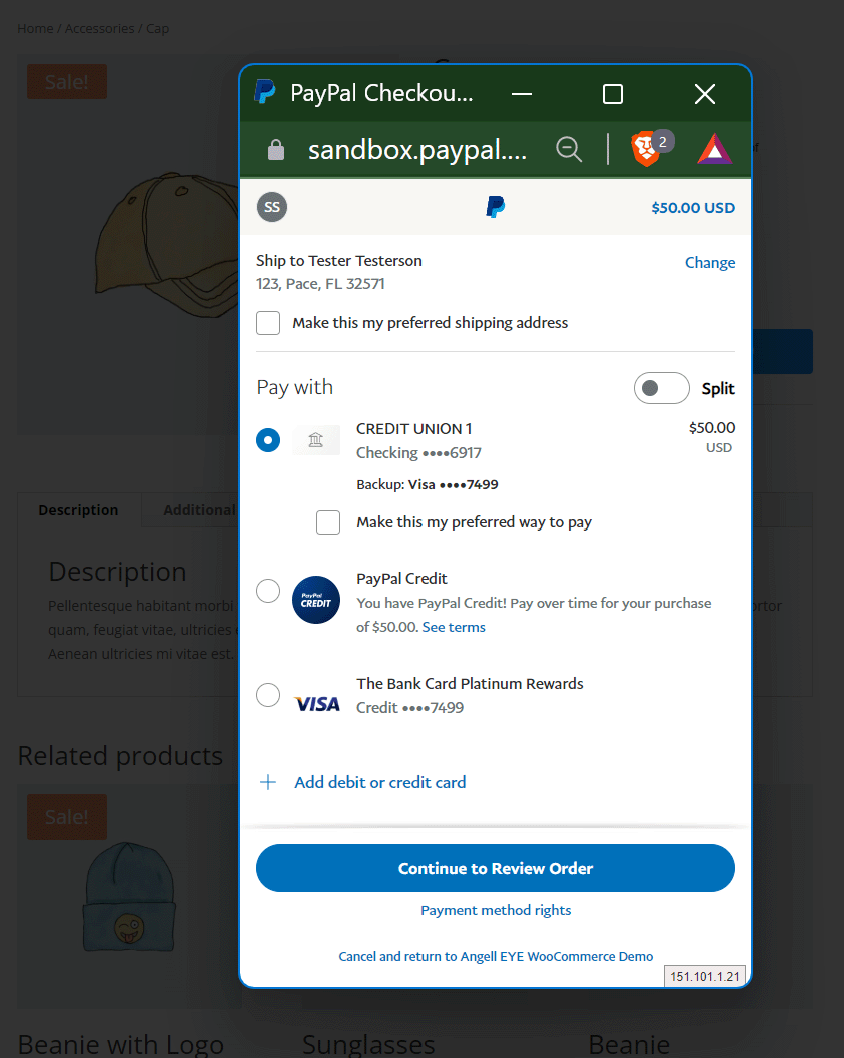

When you process a payment with PayPal (or any processor), there is a two step procedure that occurs.

- Authorization – The payment method is authorized, and the amount of the transaction is held so that it will be available for processing. No money has been processed at this point.

- Capture – The pending authorization is then Captured. This is the point at which the transaction is actually processed, and the money is moved from the buyer to the seller account.

The payment fee of 2.9% is not charged for an Authorization. As such, if the buyer cancels the order before the product or service is shipped / provided, you can simply void the transaction, and no fee would have been charged, so there is no fee that needs to be refunded.

This would also eliminate any possibility that competition or internet trolls could try to submit a bunch of orders so that you have to pay a bunch of fees.

If this sort of thing is happening, that’s called fraud, and there are other procedures in place to deal with that besides simply refunding the orders and expecting the payment processor to cover it.

Websites

Depending on how your website is built, configuring Authorzation and Capture may or may not be quick and easy.

If your site is built in a hosted platform like eBay, BigCommerce, Shopify, Etsy, etc. you will need to check the settings they provide to see if Auth an Capture functionality is available.

If you are hosting your own website you will have more flexibility to use existing tools or do a custom integration.

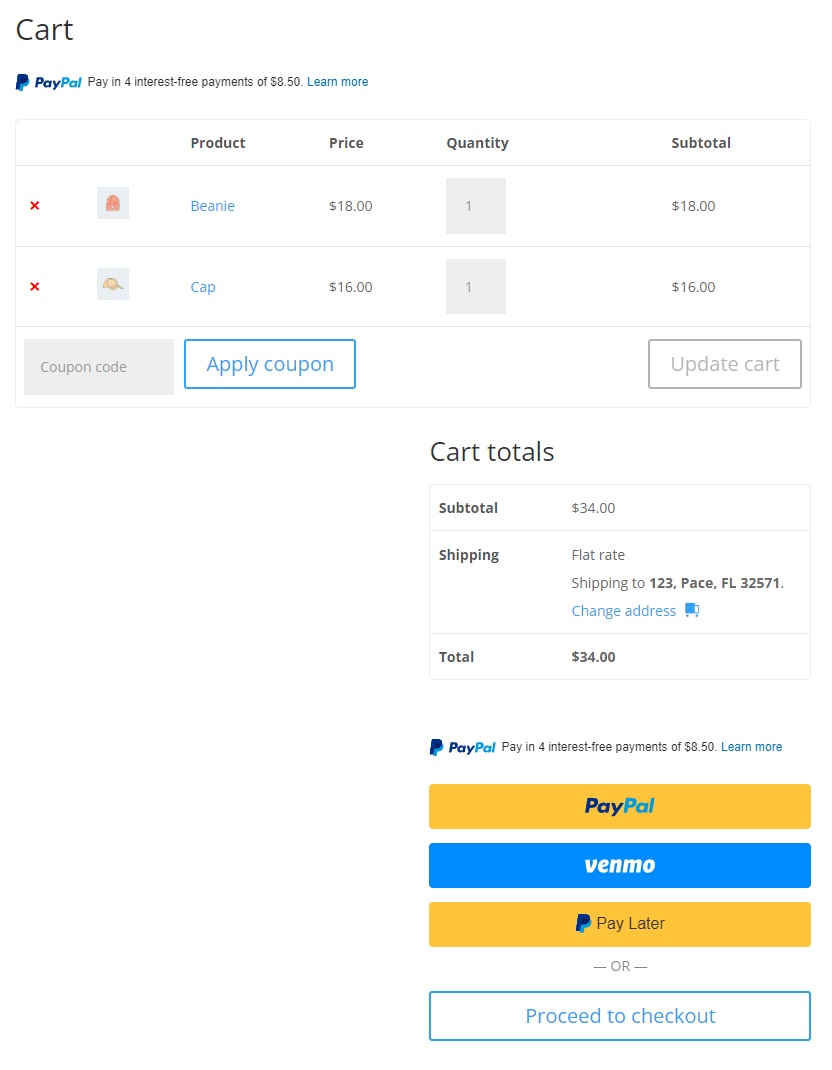

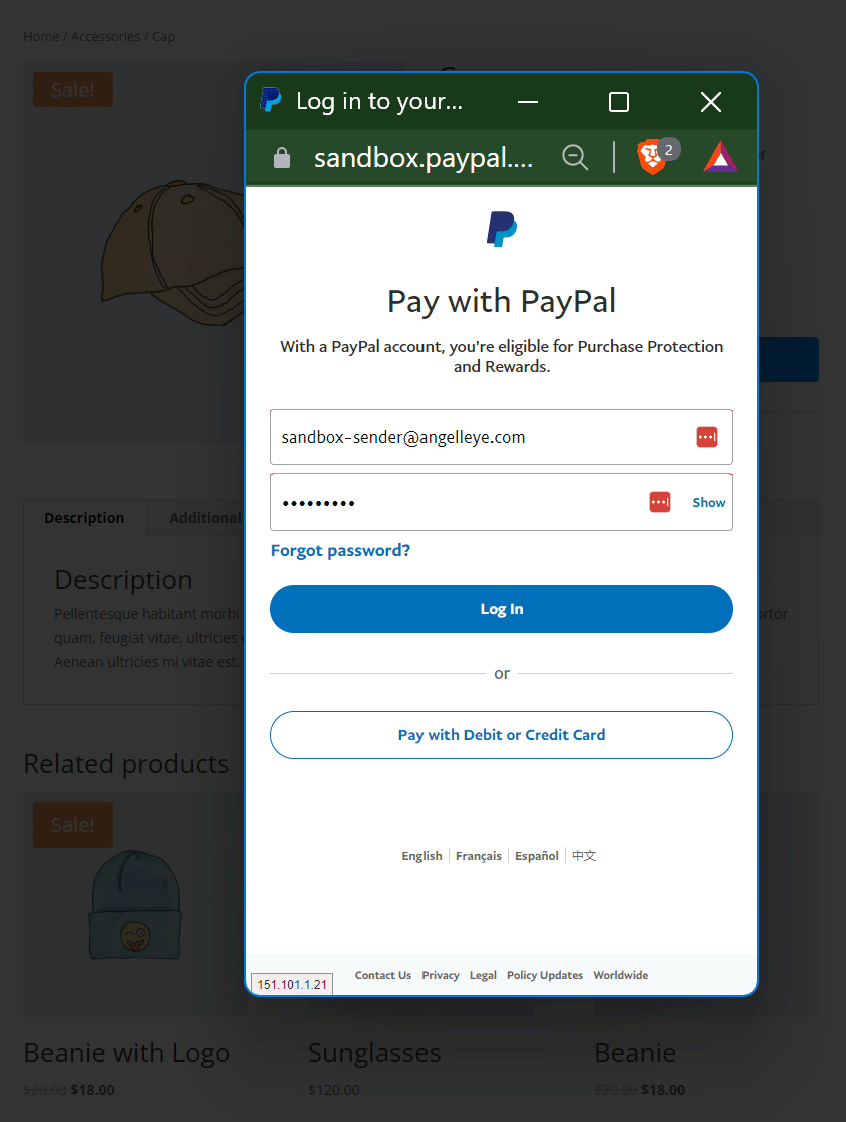

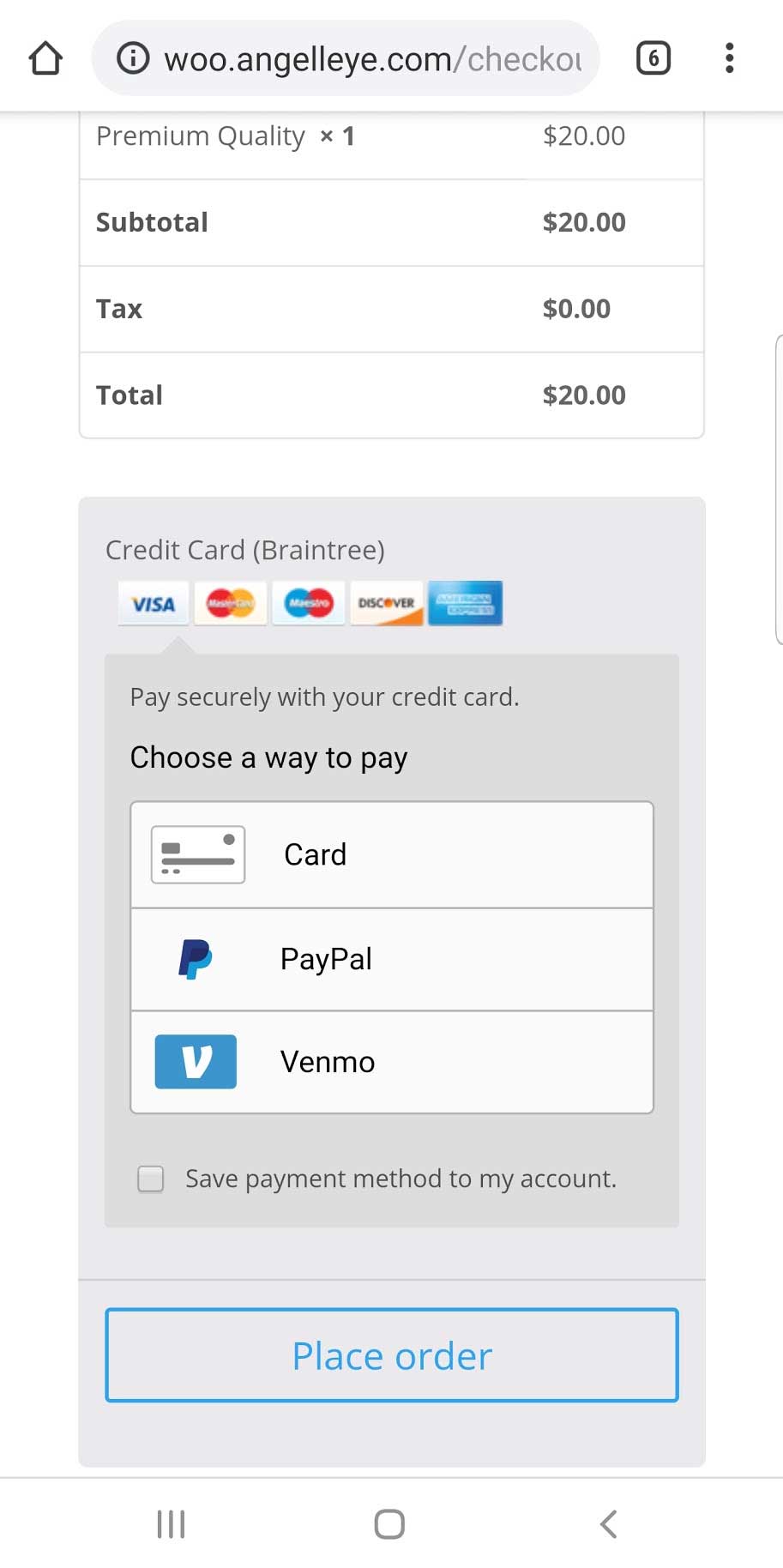

For example, if you are using WordPress / WooCommerce, our PayPal for WooCommerce plugin supports all of this with PayPal Checkout Smart Button integration as well as PayPal Pro and Braintree credit card integration.

This will allow you to process your orders with Authorization, and only Capture when you ship.

This will help you avoid unnecessary refunds because a buyer cancels their order.

eBay

To my knowledge, eBay does not allow you to configure your payments to use Authorization and Capture. PayPal provides the technology for it (it’s an industry standard), but eBay simply doesn’t integrate payments that way.

So if you are getting a bunch of eBay payments and people are canceling orders before you ship, is that a PayPal problem or an eBay problem? I would argue the latter.

If this is indeed something that eBay simply does not provide, our concerned voices should be directed at them.

Buyer Due Diligence

If you are getting a lot of refund requests after deliving your product or service, I would suggest that you need to look at your own procedures and figure out why buyers are not happy with what you delivered them.

PayPal has provided their service to you when you process the payment on their platform, and you paid your fee for this. Is it their fault your buyer is unhappy and wants their money back? Again, I would argue that it is not, and that sellers should take action to stop these refunds.

Product Descriptions

Of course, the best way to avoid such problems is to ensure your buyer knows exactly what to expect. Pictures, videos, detailed descriptions, and anything else you can provide on your product pages or online listings will go a long way towards resolving this problem.

Sometimes, though, buyers just don’t review all of this stuff, and it’s not until they receive the product that they realize it’s not what they wanted or isn’t what they expected.

If this is happening to you a lot, I would suggest that you need to make a change. Follow up with your buyers before Capturing their payment and shipping their product. Give them a call, setup a Google Meet, and really discuss all of the details with them to be sure you’re both on the same page.

Much of this depends on the type of product/service you are selling. Some items may require more buyer due diligence than others. That’s all part of your business model, and should be considered when planning what types of products/services you will be selling.

Fraud Management

It is a fact that credit card companies (not just PayPal) will almost always award a disputed transaction to the buyer (card holder.)

Some people out there are dishonest, and they will take advantage of these policies and procedures to scam sellers out of merchandise or cash. It’s unfortunate, but true, and the entire financial industry fights this every single day.

If you are selling a product / service where you find this happening a lot, it’s just that much more important that you follow up with your buyers before you deliver your product/service.

Again, talk to them on the phone or in a Google Meet. Feel them out and make sure they seem legitimate. In most cases, you can spot the fraudsters almost instantly when you talk to them, and you can simply cancel the order, Void the Authorization, and no fee will have been charged.

Conclusion

Again, I can understand why the initial reaction of some that see this is negative. However, when you look at things from all perspectives, and you consider the procedures available to avoid such problems, I think we can all agree that it’s up to us as online sellers to do everything we can to avoid refunds.

The banks don’t like refunds, PayPal doesn’t like them, buyers don’t like them, and we as sellers obviously don’t like them. It all starts with us, though. If we simply don’t Capture a payment until we know for sure our buyer will be happy, the vast majority of this can be avoided.

Return rates should be below 1%, and businesses can handle that. If you are getting higher return rates, I would strongly recommend reviewing your procedures and putting what I’ve outlined in this article into action.

Looking for Live Help?

Schedule a live meeting with Drew Angell, PayPal Certified Developer, and get all of your questions or concerns answered.

Featured PayPal Products and Services

-

PayPal Support

$150.00 -

PayPal for WooCommerce

FREE! -

WooCommerce Multiple PayPal Accounts Plugin

FREE! -

PayPal Shipment Tracking for WooCommerce

$49.99 -

Offers for WooCommerce

$59.99 -

WordPress PayPal Invoice Plugin

$20.00 -

PayPal Webhooks for WordPress

$79.99 -

Sale!

PayPal IPN for WordPress

Original price was: $59.99.$49.99Current price is: $49.99.

You have absolutely ZERO IDEA what you are talking about..And furthermore you are a complete MORON..

#1 listing 2 companies which also have this despicable practice? Doesnt make this practice “industry standard”, by any means..Thats exactly why you can only list TWO others that do this, because almost none of them DO..

#2. Why are people getting “so many returns?”…Obviously you dont sell on eBay, or have one f#%cking clue what kind of culture is cultivated on there..But FRIVOLOUS IDIOTIC returns are actually ENCOURANGED..Not to mention buyers absolutely refuse to even bother to READ a listing anymore, why? Because they dont HAVE TO..They can simply get the item, realize they f#%cked up, and just get a free return..So why not??

You also dont talk about wonderful order CANCELLATIONS!!! These happen before the sale us even partially completed, and usually seconds after a sale is paid for, its great..And now this criminal lowlife, dirtbag company thinks they have the right to keep the fees on these transactions too, when a buyer is literally refunded in MINUTES with nothing being shipped out..

Well F#%CK THEM, AND F#%CK YOU MORON

Why dont you sit down and shut up, because again you havent got clue ONE as to what youre talking about at all..J#%koff

1. I listed the two that most people are bringing up when discussing this topic. The vast majority do not refund the fees. Square is the only one I’m finding now that shows they still will. They just recently increased their fees in general, though, and I wouldn’t be surprised to see them stop refunding fees as well. Sure, you may find someone that will refund your fees when you refund, and you can certainly choose to use that processor. I would make sure you factor in all variables, though, and not let this refund thing be a primary concern.

2. I have clients who have done $500k+/mo in sales on eBay, Amazon, and other platforms. Yes, buyers can be frustrating on these platforms. We know this, and we account for it. By doing some extra due diligence as I’ve explained in this article/video, we are able to drastically reduce the amount of complaints/returns we get. It’s additional work up front, but it helps enough on the other side that it’s worth it. Depending on your product/service this may or may not be worth it to you. That’s up to you to decide as a business person. Simply blaming PayPal for not refunding your fee is just lazy.

3. Yes, I very specifically mentioned the cancellation problem. That would easily be eliminated with the Authorization and Capture procedures that I outlined here. Had sellers and platform builders bothered to implement these procedures all along, PayPal likely would have never had to introduce this policy change and would continue refunding fees, because it would be a much smaller problem for them.

So if your buyer purchases something and you only do an Authorization, and then later they want to cancel before you ship, all you have to do is Void the Authorization. No money was ever moved, and no fee was ever charged, so there is no fee that needs to be refunded.

The problem if you’re selling on eBay is that eBay does not provide this Auth -> Capture checkout flow. They simply process the payment right away, and then yeah, you’d have to process a refund later. Is that the payment processor’s fault? They clearly provide the functionality for this. Or is it eBay’s fault, that got lazy and did not bother implementing the proper procedures for checkout systems? (This, by the way, is one of the reasons a company like eBay should leave it up to the payment experts like PayPal to build checkout systems.)

On that note, Adyen Payments, the company that eBay is using for their Managed Payments Platform, provides Auth/Capture as well. I still have not seen anything about it in eBay’s Managed Payments platform, though.

So, if you’re having this problem, there are MANY variables involved. The point I’m making here is that if you solve the main root of the problem, the refunding of fees will not be a problem for you at all no matter who you’re processing payments with.

I just made my first refund since the new policy. I sell software which is automatically downloaded once the transaction is complete so I am not even covered by seller protection even though I have had a PayPal business account for 20 years and keep a large balance in my account.

The person realized after downloading it that he already purchased it. I lose 3% (2.9% plus .30).

I offer the software for Windows only. It is plastered all over the website. I still have Mac people who order it, try to download it then want a refund because they didn’t know it doesn’t work on a Mac. Like how could you not know? That will cost me 3%. It is already difficult to stay afloat. Now, it is going to cost me even more.

Most of the time the funds come from some other PayPal account. I am charged the same as a credit card sale. How hard is it for PayPal’s computers to change the numbers from one account to another account.

I feel your pain with the fact that software downloads are not covered by Seller Protection. It’s unfortunate, but the same thing is true when processing payments with other merchant accounts. If the person files a dispute, you would have to provide a tracking number from a shipping carrier showing it was delivered. Since we cannot do that with software downloads, we lose the dispute.

I have personally updated our refund policy to show that I will refund 95% of the order if a refund is requested for any reason beyond my control. So far this seems to be acceptable for our customers.

For your problem with Windows only and Mac people ordering, I would suggest that you add some sort of logic into your checkout or your product page that checks for the user’s OS. If it’s not Windows, don’t let them buy it. Display a message accordingly when they attempt to add the item to their cart.

Just because an order is paid with PayPal does not mean the funds came from cash sitting in that account. Many times users will choose a credit/debit card or bank account as the funding source when paying with PayPal. So it’s not just a matter of “changing the numbers from one account to another account.” Sometimes it may be paid with PayPal cash, but PayPal is still processing that payment for you and dealing with all the risk, liability, etc. that comes with that for you.

Believe me, I don’t want to be paying fees when I don’t have to, and the refund policy is a bit frustrating. Again, though, it’s not just PayPal, and as a business owner I understand charging for provided services. I don’t cheer for it, but I also don’t consider them some horrible company for doing it.

I’m frustrated by it, too, but we just need to adjust our processes to handle it as best we can.

This is totally wrong

Refund policy just helped you on site like ebay for instance to get good rating and have more sale.Now if i do not get the fees back I am going to moan about it,try partial refund,not paying for transport when item is returned etc..etc..On ebay you had blackmail for rating and now people will blackmail to get a discount and if you don’t they will ask for refunds

Paypal is doing that because a lot of pay with it so lots of sellers are captive

Just read on forum that a guy lost 590€ fees (like 650$) because he did not want to make a low invoice to a chinese guy so the guy asked for refund

Reading your thread I am sure you think that this is the seller’s fault

eBay makes it tough because they do not provide the standard features that would eliminate all of this; Authorization and Capture.

In your example, if the person wanted to cancel the order and it was not Captured yet, all the seller would have to do is Void the Authorization. No fee would have ever been charged, so no feed would need to be refunded.

PayPal provides this feature. Adyen (the company eBay is using for Managed Payments) provides this feature. All payment processors provide this feature.

eBay has chosen not to implement it. So no, I wouldn’t say it’s the seller’s fault in this case because they don’t have the option on eBay. It’s definitely not PayPal’s fault, though.

I would say the community should be barking at eBay to implement standard procedures so that sellers can avoid such problems.

I took PayPal off of my 2 eCommerce sites due to they no longer refund the transaction fees. Firstly, most (if not all) payment processors allow you to pre-authorize a payment, and to not charge in the cart. The pre-auth will automatically fall off usually within 3-5 days if not charged. All forms of payments that I accept, I set to pre-auth only. Because if I need to cancel the order for any reason, I can simply just void the order on my eCommerce platform and the pre-auth will fall off at no cost to me. If I do charge the payment method, and then have to refund later, all of the payment processors I work with only keep the .30 cents transaction fee, not the 2.9% so-called commission fee. PayPal does not give you the option to only pre-auth a charge, the charge is fully charged/captured by PayPal.

Also, shortly after PayPal initiated its new refund policy, I had 2 fraud orders originating from a country known for high fraud and using the same PayPal account. I simply refunded the suspected fraud orders within 1 hour after placed. I didn’t ship any product or anything. I got the funds from PayPal and then refunded within 1 hour. PayPal kept over $170 in transaction fees from me. I called them and said that those orders were suspected fraud orders, and that meant nothing to them at all! They kept MY $170. So, in that case, I didn’t have money stolen from me from an online fraudster, I had my money stolen from me by PayPal! SO, think of this….if you have some fraudster attempting to charge several thousands of dollars worth of product on your site multiple times, you can still lose hundreds if not thousands of dollars to PayPal. That is insane! I no longer accept PayPal and have started using alternatives. Amazon Payments seems is a great alternative to PayPal and many people use it.

PayPal does provide the Authorization and Capture feature. That is literally the exact thing I explain in this article and in the video, which you obviously did not actually read or watch. Had you had that in place you would not have lost that money on fees.

If you’re using a shopping cart system like WooCommerce, Shopify, BigCommerce, eBay, etc. then you’ll need to check that system to see if they provide this functionality or not. PayPal provides it like all the other processors. It’s about whether or not your platform provides it.

If you’re using our PayPal for WooCommerce plugin, it fully supports this. If you’re using PayPal Standard HTML buttons, here is a guide on how you can get that done very quickly and easily. I think you’ll appreciate the video on that page, too.

Square is the only payment processor I see that is still advertising they will refund you the fees. Don’t be surprised to see them change their policy soon, though. They are also more expensive for every transaction you will ever process on your website. You really think that’s a good trade? I’ve worked with many others, and they not only won’t refund you the fees, but many charge you additional money for processing the refund. I also provide details about this in the article and video.

I can appreciate your opinion, but please, at least skim the headings in the article before jumping straight to the comments. You never know, you might learn something. 😉

Scumbag corporate shill. Square refunds the fees and YOU DO NOT MENTION IT. WHAT A SCUMBAG CORPORATE SHILL! We used to have consumer protections, but then apologists like you come around and make the world worse.

Square refunds the fees. `If you shop around, you will see that the vast majority of payment processors follow this practice. It is indeed true that PayPal is making this move in line with the industry standard.` is a lie! Verifone refunds fees! Ingenico refunds fees! I’m sick and tired of you defending corporate scumbags and theft.

Square does still show they will refund you fees when you refund the original transaction. However, look more closely at what you’re trading here.

PayPal’s fee is 2.2% – 2.9% when using them for direct credit cards and PayPal options. Take a look at Square’s fee documentation, and you will see the following:

Every transaction that runs through your website would be “keyed-in” and would be charged at this 3.5% rate vs. PayPal’s 2.2% – 2.9% rate.

So you would trade a higher rate for ALL transactions in exchange for getting your fee refunded when you refund your customer…which should be happening less than 1% of the time..?? That isn’t logical in a business sense or an emotional sense.

Also, PayPal gives you the option accept both PayPal payments (which many buyers prefer) as well as Credit Card payments. Square is only credit cards, so you’ll lose out on all those sales where people don’t want to key in that data. I think you’ll find there are many, and your conversion rate will drop significantly.

I understand that it’s easy to emotionally react to things like this, but you really need to make sure you’re reviewing all of the details or you’ll only put yourself in a worse position. You can me a shill or whatever, but the reason I choose PayPal for myself and for my clients is because they provide the cheapest overall rates with the most features and flexibility over any other processor.

I have shopped with MANY processors. No, the “vast majority” do NOT offer refunds of fees. Square is the only one I’m seeing still showing that, and I would not be surprised if they remove that soon just like PayPal did.

Show me a better solution when all variables are considered and I would seriously consider switching myself and my clients to them for credit cards.

I just showed you why Square is not, so let’s take a look at another one. Happy to compare any other processor you feel is better.

Paypal is sooo generous. Only Keeping the 2.9% fee. They should keep the whole payment Transaction and make the sellers responsible for all Refunds. Lol. That way they can screw people without morals. I bet target, Walmart, or any Department Stores where i buy and return an item 30 days later and and the credit card companies will not keep a dime of their 1.5-2 percent fees.

High volume sellers can indeed negotiate things like that into their deals with payment processors, and PayPal is no different. If you’re bringing them that much business they’ll be more likely to work with you.

That said, if you have a specific argument to everything I’ve outlined in this article I’d be interested to hear it and discuss it with you. As mentioned, the vast majority of the payment processors have always done this, and will even charge extra for the refund transaction itself. I provided examples of this.

Square is the only one I’m seeing that still advertises they will refund fees, however, their rates in general are higher for keyed transactions, which would be VERY transaction on your website. Would you rather trade a higher rate for all transactions in exchange for refunding of fees? That doesn’t sound like a good trade to me.

Are you processing a bunch of refunds? If so, I would ask why..??

How exactly is this going to affect you and your business? Are there things you can adjust accordingly?

We just processed a 1,400.00 order via eBay (2nd purchase from the sale seller within hours) and we noticed that these were shipping to a different address than the first purchase. So we cancelled the order and PayPal issued the payment as usual with the exception of the processing fee they retained. Of course I was a bit confused as I once read that PayPal was going that route and the last that I read was that it was not going that route.

So I called PayPal and explained that we cancelled the order as we felt that it was most likely a fraudulent transaction. Sorry, we changed the policy and no longer refund the processing fee. So I asked the kind gentleman, had I shipped the order to the “eligible” shipping address and later there was a chargeback due to unauthorized transaction, the PayPal rep stated that the entire transaction would have been covered by PayPal Protection including the processing fees. So it may be in everyone’s best interest to ship to the address provided and let PayPal deal with the chargeback. This of course does not help for other cancellations or returns but you are 100% correct that eBay should be permit authorization without capture and will be writing to them as well.

Excellent article by the way.

Yes, it’s a frustrating situation, which could all be resolved on eBay if they provided the Auth and Capture functionality. I really hope they see all of this and decide to implement it. Thanks for your feedback!

Interestingly, I got this email from eBay after the order was cancelled

“Hi XXXXXXXX,

You’ve refunded $1,400.00 to the buyer for canceling this order. We’ve notified them, so you’re all set!

You’ll get a final value fee and payments processing fee credit in your account that you can apply towards listing more items to sell on eBay.”

So I called eBay thinking that eBay was refunding the payment processing fees charged by PayPal however, as usual, the Ebay rep did not understand English very well and tried to issue a credit for the FVF which was already in my account. When I mentioned to the rep what the eBay email stated, he said you’ll have to talk to PayPal about the fees. Do eBay and PayPal not communicate with each other or do they like to keep customers guessing in the dark all the time?

They became separate entities again in 2015, and since then they really don’t have the same sort of communication between each other. This is all part of the confusion, though, which I have discussed quite a bit with people on reddit. I provide lots of detail in this thread.

Basically, eBay’s policy is that if the payment processor refunds them the transaction fee, then they will refund you. PayPal and Adyen Payments are the processors they work with, and neither will refund the payment fees when you refund the transaction. In fact, Adyen charges additional fees for the refund transaction itself, which PayPal does not.

Both PayPal and Adyen support Auth and Capture. Why eBay has not implemented it is something they will have to answer to. Hopefully they will, and the answer will be to introduce it soon, because this problem isn’t going to go away on its own.

I just sold a Laptop on eBay for $900 on January 3. The buyer is located in Brazil, but has a shipping center in California. (I DON’T AND NEVER WILL SHIP TO BRAZIL) He buys the Laptop, puts in a Delaware shipping address, then emails me and says to ship to the California email address he’s providing in his email. He did this to avoid paying California Sales Tax, or he’s trying to scam, either way doesn’t matter, after explaining why I can’t do this, he insists on a cancellation.

Sellers are held at gunpoint, no way out of this situation, we MUST COMPLY as we know resistance if futile.

I cancel the transaction, eBay refunds my FVF, but PayPal charged me 4.55% because obviously his PP account is Registered in Brazil.

I was just ROBBED $41 taken out of my pocket for NO REASON of my own doing.

Oh but this is “In line with industry practice.”

I’ve used PayPal since 1997-98 when they were X.com 2 weeks ago I loved PayPal, today I can’t wait to close my PayPal account! F**K Y*U PayPal!

I expect eBay managed payments to be WORSE. We will have to see.

The problem you outlined here has a very simple solution that PayPal (and all payment processors) provide; Authorization and Capture.

The problem is that eBay does not provide this functionality in their platform. I have not seen that it will be included with Managed Payments either.

This is not a PayPal problem. It’s an eBay problem.

You have no clue about retail… We sell items that have a high return rate because they are a very specific fit. If you sell clothing, shoes, you are going to have a higher than 1% return rate. What fantasy retail land do you live in with a 1% return rate for online purchases? My credit card processor charges a lower % and refunds fees on returns. Amazon refunds fees on returns. I’m a high volume seller and it doesn’t look like paypal has implemented this change on our account, but if they do, bye bye paypal

So who is your credit card processor? Why would you say something like that and not share the knowledge?

Nah, you really have no idea what you’re talking about, or you’re intentionally ignoring the fact this is a money grab: regardless of industry standard. Don’t worry, when ebay falls apart you will probably blame it on sellers. In reality we know you’re a troll, plain and simple. No need to respond to me. I dont care for a long convoluted shill explanations of how it is the sellers fault paypal can reverse payments six months from buy date. I stopped selling on ebay, and will stop buying the day all the honest sellers fall off the face of the shill cliff.

First, to call this a “money grab” is a bit of a funny thing. Yes, they are a public corporation that is looking to make a profit. This is exactly the same as all the other payment processors competing with them for the business of merchants all over the world.

Second, eBay has nothing to do with what I’m talking in this article (except for the fact that they do not provide the Authorization and Capture solution to canceled order problems that I mentioned.) In my opinion, eBay is already falling apart, and it has nothing to do with the sellers. But none of that has anything to do with PayPal either.

It’s not PayPal that can reverse payments six months from the buy date. It’s the credit card companies. In fact, I’ve seen it happen over a year later. It all depends on the card issuing banks and circumstances involved. PayPal’s 6 month policy is to protect themselves and account holders on their platform as much as possible. Whether you use PayPal or any other processor, though, if the buyer submits a chargeback 6 months later (or longer) you’re going to have to deal with it the same way you would with PayPal. If you use some other service not realizing that, then you’re just going to find yourself in the same boat again, blaming that provider for your problems.

That’s great that you’ve stopped selling on eBay. Again, that’s an entirely different topic. I recommend to people to sell on their own website as much as possible, and use PayPal as the primary payment provider for all the reasons I explain in my articles, YouTube videos, and software that we develop for people, which includes PayPal integration and the integration of many other payment processors.

Please, tell me a payment processor that is “better” than PayPal, and outline the reasons why. I have not been able to find one, which is why I use PayPal, and when they change a policy that is exactly in line with the rest of the industry…meaning it won’t do me any good to switch to somebody else over this matter…I don’t let it bother me.

I adjust my own procedures to make sure I deal with the situation, and I would suggest you do the same.

Drew you reviewed only a few payment processors. Regardless who the payment processor is or the pricing model they use, Flat Rate, Tiered, Interchange Plus, etc., all processors pay the same exact same interchange fees for the most part. Also these processors when performing a refund for a seller (merchant) they submit to interchange for a refund of the fees paid into the card brands interchange programs. The refunds can be more or less than what was actually paid originally depending on card type and if it is CNP/MOTO or CP. So let’s see PayPal won’t give the seller back anything, but PayPal gets a windfall off the back of the seller when they do a refund. Rough example. – $100 sale fee is about $3.25. Interchange fee on an average Visa CNP reward card is 1.95% & 10 cents, so $2.05 gets paid interchange by PayPal out of the $3.25. Also dues and assessments will be paid as well. So for arguements sake let’s say PayPal keeps $1 after all fees paid out. Not bad for this card type. But now a seller does a refund for this sale, PayPal of course is going to request fees back from interchange, the Moto reimbursement rate for Visa is 2.05% or $2.05 they will get back. So paypal went from making $1 on the sale $3.05 from this transaction history. PayPal wants people to do more refunds because now they will make more money, time to buy PayPal stock!!! PayPal had a loyal following and if they at least offered to give back a partial refund of fees I think sellers would be agreeable, but to be greedy like other kids on the block to me is not a justification for the new policy. Sellers can find payment processors that will give all or of the back, they just need to look, or if they want the best pricing model available they should demand a Net Interchange Plus pricing model so that they get back all of the interchange fees they are entitled to when doing a refund. What is your take on PayPal keeping the interchange reimbursements intended for merchants?

Yes, I only mentioned a few here, because these are the few I see most often mentioned in the communities where people are discussing this topic. I have personally compared many others as well. If you have one I left out that you would like me to compare, please let me know. I would welcome a “better” processor than PayPal. I just haven’t found it.

You say “sellers can find processors that will give their feedback, they just need to look.” Please, don’t just say something like that and let fill us in on the goods. If you know a processor that is BETTER, tell us who they are. I would love to do a true comparison and see exactly where they are better (and where they aren’t.)

For example, Square is the only one I’m seeing that still advertises they will refund your fees. However, they charge a higher rate than PayPal for all keyed transactions in the first place, which would be very transaction that comes through your website, of course. So it wouldn’t be logical to trade a fee refund on refunds in exchange for higher fees on every transaction you ever process.

Other processors also have crazy structures that dance around the models you mentioned like interchange+, etc. so you never really know what you’re being charged. They have statement fees, PCI compliance fees, and a lot more.

So again, if you know of one that is actually better when it comes to the overall cost, ease of use, security, integrate-ability (is that a word?), etc. then please tell us.

There are millions of transactions, almost all being handled by software written to get rid of employees to increase profits. Now for work that is done by electrons, they want to KEEP FEES for completely legitimate refunds. They do literally nothing to earn that money. They obviously did just fine before. This is clearly a rule with one intention. I had an item on eBAY sell recently, and the guy didn’t pay for it. So, I get the blessing of making sure I get my fees back for something that wasn’t even paid for (I can do this manually, or set it up to do so automatically through eBAY). eBAY then says — HEY RELIST IT! So I did. I made the very minor (though common) mistake of relisting when the original listing was for up to QTY 2. Well, I didn’t notice. A dude buys both. I IMMEDIATELY see it, write him back, apologize and tell him “I can give you one and do a partial refund, or refund the whole thing.” Literally NO WORK FROM ANY HUMAN. Completely automated. No exchange at all to this point. Just need to ‘cancel’ and refund. Just return the damn fees! Nothing happened! This is 100% corporate greed and unacceptable. As if eBAY hasn’t gotten ridiculous enough, now this. I am absolutely fed up with eBAY turning their marketplace, where a seller and buyer can shake hands and make a mutual transaction. They instead have stuck their nose into everything. They have continued to increase rates throughout the years when they have always been profitable. If something is growing, there’s no good reason to raise rates or fees OTHER THAN to take more of it away. Why the change? Greed. Pure and simple. There is no other answer. It’s pathetic. They have ruined the marketplace and forced everyone to look like an employee of eBAY instead of their own, fun, trust driven entity. I’m out. I’m done. This is it. They want to take money from honest, hard working people when software is handling all their work — to benefit — only a few.

I understand how stuff like this can make you emotional. but come on, really think about what you’re saying and what’s happening here.

“Work done by electrons.” “They do literally nothing…”

Whose computers are those electrons firing on? Who’s paying for the internet connections? Who’s paying for the server admins to manage all of that and make sure it works every time, quickly and securely? Who handles all of the PCI compliance and relationships with banks across the world to build these bridges that we walk across every day so effortlessly?

In your example, you admit that you made a mistake. Had you not made that mistake, this problem would not have happened. That sort of thing does happen, though. I’ve done those sorts of things myself.

This is just another example of what I talk about in the article and video (which it seems you didn’t actually read or watch). If eBay had the Authorization and Capture system built into their platform, and you were using it, you could have simply Voided the Authorization for the order you couldn’t fill, and no fee would have ever been charged in the first place.

The fact that eBay does not provide this for you is not PayPal’s fault. PayPal (and all payment providers) make this option available for those integrating their services. Why eBay chooses not to implement it..?? I don’t know. I think we need to be throwing heat their direction, though. Not at the payment processor.

“No exchange at all to this point.” That’s simply not true. Money WAS exchanged between bank accounts. Those systems that these banks spent billions of dollars to build over the passed 20+ years moved the buyer’s money safely and securely from their account to yours. You were charged the fee that you agreed to pay for such a transaction. Now, because of a mistake, you are asking them to reverse that, and move money back across those systems they built safely and securely, so that you can all move on with your lives. That’s a pretty valuable service if you ask me, and it’s one I’m happy to pay for.

Also, PayPal pays fees to these banks for moving all of that money, too, and then that causes more procedural effort that needs to be implemented. Do they refund their fee? Some do, some don’t. Now they have to pay their partner managers and developers to build in a bunch of if/then logic, test it, deploy it, deal with bug reports, etc. Heck no, it’s easier just to kill the refund…especially when your competition isn’t doing this either.

You can certainly go back to check/cash if you want to. That’s an option we all have, and some of my clients still prefer to pay me that way. It just slows things down, but it works, and it’s certainly an option for you.

Again, though, had an Authorization been placed instead of a Sale, you could have canceled the order with no fee at all, because no money would have actually been moved around yet.

Greed? Eh, no more than any other business. Are you a small business owner? If so, take a look at your financial statements. If you ever saw one category in your expense reports jumping out at you…and then you look at your competition and you think…none of these guys are doing this…why are we eating all these fees when we don’t have to be? We can drop this expense line by x%, which will boost our bottom line. I guess you can call it greed if you want to, but to call PayPal out for it and act like they’re the only one doing it is just not realistic.

I would recommend that you take your complaints about your example to eBay, and ask them why they don’t offer Authorization and Capture.

I would also recommend that you do your best to sell as much on your own website as you can. This gives you complete control over things like Auth and Capture, and you don’t pay platform fees at all.

To be honest, this literally does suck. I sold an item of a thousand bucks, the buyer asked to cancel after payment indicating that he/she purchased the item in an error. Refund was sent and PayPal charged the seller about 30 bucks for a transaction that was not shipped and refunded right away? This is absolutely ridiculous.

It would make more sense if PayPal charges these fees AFTER THE ITEM HAS BEEN SHIPPED or worst case scenario inform the buyer that the refund will be processed within 3-5 business days thus not having to charge the seller a 2.9% fee. These sellers are humans and majority of them do all they can to avoid refunds but we all know that some buyers can be hardly pleased. Another option would be to place a cap fee of about 5$ on all refunds above $20 regardless of reason for the refund.

I can barely afford 30 dollars, even as a healthcare worker during this pandemic we risk our lives and could barely get $18 per hour of cleaning a patient’s poop, bodily fluid, back breaking activities, and standing all day, then I decided to sell my phone to burry a family member and you take my 30 bucks because the buyer requested for the item to be canceled? If I fail to cancel then I get sucked in at the end where the buyer decides to play a prank because the item was shipped even when they asked that it shouldn’t or get a negative feedback on the site I am managing to sell peanuts on to make ends meet.

Oh WOW!

Hi Ethel,

I understand the frustration, but it seems you did not read my article or watch my video. To solve this problem all you have to do is process your orders as Authorization. This holds the funds on the buyer’s account but does not actually move them to your account yet. When you know you’ll actually be shipping the product, that’s when you capture it and claim the cash. That is the point the fee is charged. If the order is canceled, you simply Void the Authorization and no fee was ever charged.

That is the proper way to be handling payments online. Had people been doing this properly PayPal wouldn’t be moving all this money around all over the place for nothing, and likely would not have had to make this change. I’m not blaming you for it. They should have taught people about this better. I do my part to try and do that, but I get called a shill, so, well, there ya go.

I would suggest that you adjust your procedures to follow this model, and then you will never have to worry about this again whether you’re processing with PayPal or anybody else.

Drew:

In a failed transaction NOBODY COMES OUT WHOLE! Refunds are a part of doing business. All vendors and sellers do what they can to dilute snf mitigate transactions that fail. A business broker does not get a commission if the deal does not close, A retailer can no longer sell a new product as “NEW” if it has been purchased, opened and returned. Most times the retailer must send the item back using reverse logistics, or simply sell the item as an “open box” item and accept a lower price. A salesperson’s commission is not earned if the item the salesperson sold is returned, as are sales commissions for all kinds of sales earned just because they put together a detailed sales proposal, so your analogy to Papal using there service is a poor analogy.

Rather than robbing Peter to pay Paul, Paypal should do away with ther “free to friends and family” and charge a fee for all COMPLETED transactions. The retention of fees when a transaction ends up in a refund is just a POOR POLICY. Refunds are a part of doing business, but Paypal’s retention of fees adds insult to an already INJURED TRANSACTION. No one should be insulated from their share in a failed transaction

Hi David,

If a broker doesn’t close a sale, then there was no transaction. If the transaction does happened, but is returned, and the salespersons deal with the company is to only receive commission on closed sales, then it would make sense they wouldn’t get that commission. I understand retailers can’t sell a product as new if it’s returned. None of this has anything to do with a payment processor providing exactly the service they said they would provide.

So your solution to this problem is to eliminate the ability for people to send cash to each other personally for free…?? That sounds like a very good way to get even more backlash than they’re getting right now.

I don’t like refunding people any more than anybody else. I don’t like that PayPal had to make this change any more than anybody else. I simply do not fault them for it like most others seem to. They are providing a service that I use on a daily basis. When I have to provide a refund, they provided that service for me twice, and they did it EXACTLY as they said they would; quickly and securely.

I can certainly choose to take payments with cash/check. If I do that, then it’s that much easier for me to deal with refunds however I want to deal with refunds. Of course, along with that decision comes all the disadvantages of dealing with business that way. I also have the option of using Square, who is still showing that they will provide refunds. Of course, that comes with the disadvantage of not having PayPal as an option on the site, or having to now integrate and maintain two separate payment gateways.

PayPal is not forcing you to use their service. If you choose to do so, and they provide that service exactly as advertised, they should not have to refund you for that. That makes no sense.

Just my opinion.

It is completely unfair and unwarranted. Example, I do local deliveries only but I do have overseas customers who buy for a recipient locally. So i leave the option for other countries to purchase.

Unfortunately, some customers still make the mistake that we deliver overseas and buy thinking we will deliver. I have to explain to them and refund them. It is not common bt it happens.

What I dont understand is, why should i be penalised? There is no goods being sent, nobody is losing anything but Paypal has decided to punish me for something I have very little control over.

Worse is if some customers decide to purchase a huge amonut say 1k, only to find out I Do not deliver overseas. So i have to call them and tell them we cant and we will refund but now I have to pay $40++ for something that was not delivered. Already paypal is charging 4% from the hundreds of sales i do ,and easily we have 5-10k sales a month on paypal. Why cant they absorb this amount?

I will be forced to make some decisions if I lose $$ for company policy. Its either i choose another payment option, or I completely remove this payment mode.

The Authorization and Capture I offer in this article / video would solve the problem in the examples you just gave. Please at least read/watch the content before continuing to complain about the problem.

Did you authorized the overseas transaction? Or capture?

If you are taking a $40.00 hit for a sale that does not go through, who is responsible?

Did PayPal do anything wrong ?

They delivered the service promised. But you want them to take a $40.00 hit because you made mistakes.

If it is an overseas customer… are you making them verify that they are aware that you do not ship overseas?

Why is the PayPal transaction completed / finalized / captured before you have sent the product?

Let me ask this, if your online system accepts a $1000 order for a thingamijig, but you, for whatever reason do not have one to sell, so you have to refund …. who is at fault ?

The customer? PayPal?

Or you?

In your own example above, if that overseas customer places that large order and you “have to call them and tell them we can’t and we will refund “

Should PayPal also pay the long distance charges to call that customer?

Why, when you call this customer offer to ship with an additional shipping charge ? Or, what if shipping costs $20.00. The customer won’t pay to ship, are you going to cancel the order and take a $40.00 hit? Or do you ship the thing yourself and reduce your expense?

The original poster here makes a very valid point. You, as a business owner, need to put in place the steps to mitigate these costs.

Companies are just trying to survive, while I don’t like paypal doing this and I’m sure paypal would prefer no doing it, is just the cost of doing business, paypal cost of doing business has increased, just like other business, the reason paypal became what it was is because it wasn’t just another industry standard and the regulations on paypal were lower, the last year 2019 we had massive tax increases (sales tax) almost every state is now charging sales taxes now and a lot of countries are doing the same, and the cost to paypal had been massive, the amount of people now having to working on paypal just making sure tax collection is done correctly is a lot, this has increase paypal cost, add that the amount of regulations passed that most people don’t know and cost just keep going up, I’m surprise they haven’t increase their fees, but they eventually will, people need to understand that is the government the problem, this will happen all over the economy, banks will start looking for ways to increase their fees as well, while I don’t like these new fees now I have to pay I think that paypal is no the one to blame.

If it was actually a cost of doing business, then every payment processor would do it. But it’s not, so they don’t. I have NO issue if they keep the base transaction fee. That is completely reasonable. It’s NOT at all acceptable to keep almost 3% of the transaction for literally nothing. I’m curious if they are setting themselves up for a class-action lawsuit… I’d like to think so.

Hi Dan,

I understand the frustration, but let’s go through your statements here.

First, what other payment processor is NOT keeping these fees when you process refunds? I’ve reviewed many of them, and most of them will not only keep the original fee, but they’ll charge you an additional fee for processing the refund transaction. The only one I see still advertising that they will refund fees is Square. So that is one option I know of you could switch to, but then you’re giving up all the other benefits that PayPal provides. Also, it wouldn’t surprise me at all to see Square change that policy to match everybody else soon. Again, I don’t see anybody else doing this.

Then you say that they did “literally nothing”. That is simply not true. They built the entire platform, they provide the services and security, and they make receiving and refunding payments very quick and easy for you and your buyers. That is something. That’s a pretty big something, actually. You could very easily go back to requesting check or money order through the mail and deposit payments into your bank that way. Obviously, you lose the benefits there as well. You did use their service, and they provided for you exactly what they said they would. They moved money from one bank to yours, and then back again. These things are a lot more than “nothing.”

Again, I get it. I wish they were still refunding fees as well, but it has really not been an issue at all for myself or any of my clients. Take care of your customers and they won’t ask for refunds. In situations where that’s just unavoidable, you should be using Authorization and Capture. Had people been doing this properly to begin with, PayPal wouldn’t have been moving all that money around for free, and they might not have made this change.

A class action lawsuit?

Did you happen to sign an agreement with PayPal when you signed up to accept payments through them?

That’s your contract ?

That contract was written by a whole bunch of lawyers who have put in your responsibilities to PayPal and PayPal’s to you.

I am willing to bet that when you capture a charge… you are confirming and completing all responsibilities to each other have been met.

If it is NOT acceptable for them to keep this fee, then set up your business to mitigate the risks and manage that expense.

The OP has suggested several ways to do this. Did you read what he wrote?

If you don’t agree with the way PayPal does business, you do have the option not to do business with PayPal.

Be careful though, the grass is not necessarily greener on the other side of the fence, and it might also be bitter.

Hi, I run a small business and often send a customer a PayPal invoice. Occasionally they will give PayPal one address and then email and say can you deliver to a different address. This happened yesterday a Ms the guy had moved house. I refunded him but lost the fee. I can’t just ship to the wrong address because of seller protection. Can you suggest how I can avoid this? I am in an EU country so I don’t believe I can withhold a refund and in any case I don’t want to annoy the customer because normally I will still make a second sale to the correct address.

I also do not recommend ever shipping to an address other than what’s on the transaction details and showing seller protection. That’s the right move.

With a PayPal Invoice, that is a bit of an issue because it doesn’t have the Authorization and Capture ability tied into it. When people pay an invoice it’s always paid as “Sale”.

The first thing I would suggest is to try and verify the shipping address with buyers before they pay the invoice, and make sure you have already gotten the shipping address they want so that you can specify it on the Invoice.

If that doesn’t work well enough or it begins a big enough problem, you could always consider building your own simple Invoicing system using the PayPal API, which would give you more control and allow you to tie Authorization/Capture into the mix.

Sorry I don’t have a more simple answer, but that’s the best I can give you on that one. Let me know if you have any questions or concerns about that.

This is a BIG problem. THE WHOLE IDEA for online payments is it makes it easy for anyone to buy stuff for others. Etc I can be buying a present for my uncle overseas, so it is extremely common for the buyer address to be different from the recipient address. The system is just flawed

Well, it’s not PayPal’s system that’s flawed, though. If you take a credit card through any other processor, then ship merchandise to a random address that is not associated with that card at all, and a chargeback is filed, you will lose that dispute every time.

Also, here’s a rule I like to try and follow as much as possible. If I come to you with a problem, I try to also come with at least 3 possible solutions, which is what I have done in this article/video. You are not accepting those solutions, and you are coming back at me with this problem. What are your solutions?

No, your system is flawed!

You own the business ?

Whose systems are in place when a customer makes a purchase ? Yours.

Who designed those systems and procedures ?

You.

Do you allow for the purchaser to verify their billing address for verification, but add or differentiate a shipping address ? This seems to be standard operating procedure.

Or, upon checkout do you make the customer acknowledge that you can only ship to the billing address?

Is the transaction authorized at this point? Or is it closed and captured?

When you close and capture the transaction you are verifying with PayPal that the transaction is complete. You are verifying with PayPal that the contract for service on this transaction has been fulfilled . You are confirming to PayPal, or, giving them permission, to charge you for the service.

Personally, I feel 3% to PayPal is outrageous. My alternative is to accept VISA. and pay them 4%.

AHHH.. this is nonsensical. The VAST majority of Paypal payments involve transactions from one Paypal account to another. There is NO fees on Paypal’s part as it is simple an automatic data shift on some computer somewhere. So, they are MAKING tons and tons of money. It is not no different than EBay’s ridiculous policy of making the shipping cost of an auction be including in the final value fees the seller has to pay.

Who built that system that processes all these payments quickly, easily, and securely for you? Who maintains all of the servers and the data to make sure that stuff stays that way, twenty-four hours per day, seven days per week? What makes us so special that we should just get that service for free?

The whole idea of paypal is to have something virtual and avoid the same fees as the banks. If they are going to do this its defeating its purpose as an alternative cheaper way to exchange currency.

I would disagree with that being “the whole idea of PayPal”. It’s about quick, easy, secure payments, globally. They provide that service, and they charge their fee for it accordingly. Am I happy they made this change? Of course, not. However, I can see the reason and logic behind, and it doesn’t build up this hate my veins like it does others, which I still just do not understand. Adapt and move forward. This is really not that big of a problem unless you allow it be.

We’re not asking for it to be free, only fair

a) they keep the base transaction amount.

b) they keep 2.9% of the successful transaction amount

I don’t think any reasonable person could make a logical argument that keeping the base transaction fee isn’t fair. But pretending that they add 2.9% of value, or performed 2.9% of the ‘work’ on a canceled transaction is absurd. You have to admit that.

I just replied to your other comment with a lot more detail where I did indeed provide a logical argument about why keeping that fee is fair. They are moving money all around these banks for you, and keeping it secure, and making it happen very quickly for you. If you don’t want to pay for that, don’t move the money. By that I mean that you should be using Authorization and Capture. If you Void an Authorization then no money was ever moved, and there is no fee to worry about at all.

I think it’s they make a lot of money in low currency rates, 3% minimum, charge for every transaction,but for moving from 1 PayPal to other and back with out sales is too much.

It’s robbery and nothing else.

And they stilling it from small family business people.

For my family budget every 10$ matter . They a richest company in the world and do that dirty business with non refundable fee for canceled transactions.

Go to f-n mars with your boss and burn there.

#boycotpaypal

There are many ways to address currency conversion. You can hold separate currency balances in your accounts, for example, and no conversion would take place. So if you’re sending money between PayPal accounts like you said there would be no loss / conversion.

They are not stealing anything from anybody. They are providing a service, which people can choose to use or not. When you use it, you pay for it. Simple as that.

Elon is not associated with PayPal anymore, by the way. Hasn’t been for many years.

Sorry Drew, but I’m not sure you understand how the currency or regional system works in PayPal. I have both Canadian and US PayPal accounts, and when someone sends me USD to my Canadian account, it costs me the greater of 1% or $3.99 to move it to my US account – EVEN THOUGH THE CURRENCY IS THE SAME. If I convert it inside my PayPal account, then there are the currency conversion fees (the same as any bank, but ~1/2% higher).

So yes, you can hold whatever currency you want in the account, but they gouge you coming or going to get it out. I get that it’s an industry standard to charge a conversion fee within an account… But to charge a minimum of $4 to move USD to USD merely because of an invisible non-existent ‘border’ is absolutely insane.

I’m not familiar with what you’re talking about here, I guess. I’ve never seen a fee of any kind for moving USD to USD. That doesn’t make any sense to me. What exactly are you doing?

If you have one PayPal account with USD in it hooked up to a CA bank, and another PayPal account with USD in it hooked up to a US bank, then just send the cash from your CA account to your US account, and then transfer it form there to your US bank.

When you send yourself a Personal Payment there is no fee for moving the money from one account to another. Then transferring from there to the linked bank is the same as any other. No fee would be happening when you do this.

Please elaborate if I have misunderstood something and I can try to help more.

Nice article and very helpful, We have run into situations where we have had sales that were fraudulent with stolen credit cards (unverified purchasers) and shipped to addresses where the home was vacant. Through our due diligence we found out the transaction was fraudulent and just refunded the sale, eating the processing fee. So setting our Paypal checkout to Authorize should take care of this as we get about 1-2 of these transactions a month. Thanks for the detailed explanation on the Paypal payment process

Yes it should help. I would suggest you never ship to an address that is not confirmed, meaning it matches the billing address on the credit card. You can see this form the Address Verificatin (AVS) value of PayPal Pro credit card transactions, or the Address Status (confirmed vs. unconfirmed) with PayPal payments. Or just make sure that you ship to the exact address on the transaction that shows Seller Protection = Eligible.

The Authorization will help you with orders that are canceled/refunded prior to shipment. You do want to make sure you capture an Auth prior to shipment, otherwise the Capture could potentially fail and you wouldn’t be able to collect the money for the item that was already delivered. Just want to make sure that part is clear.

Thanks for the additional tips, very helpful. I also just read your post on using the standard Paypal button with the added paymentaction parameter, very good information I will give that a try also.

Author, what’s your connection to PayPal? It’s obvious there is a link, as this is a pretty biased article (shown by what is written and by ads). Why didn’t you write this up front?

PayPal is/was already making an extremely lot of money, and this is add-on is just 100% robbery. It can’t be defended by stating it’s an industry standard, as it isn’t. It’s a big problem for sellers. We’re now charging fees for buyers who want to use PayPal in our webshop (that helped), but buyers cancelling eBay orders minutes after paying is a real problem.

I am a PayPal Partner / Certified Developer. I do not hide this anywhere. My site and YouTube channel make that very clear. That said, I am not directly employed by them. My bias comes from the fact that over nearly 20 years of payment processing, and using MANY different processors, my opinion (based on the facts of the industry and extensive research and comparison with competitors) is that PayPal is the overall best value for processing payments online. That is the sole reason I use them for myself and recommend them to my clients.

I did write this “up front”. What have I said in this article that you are claiming to be false?

How can you call it “robbery” when they provided the exact service they said they would provide? The fact is, it was a perk that they were giving people above and beyond what other processors provide. Merchants took advantage of it, though, either knowingly or unknowingly. By not properly utilizing Authorization and Capture, cash was moving around their system that did not need to be. LOTS of it. This is not free, and any well run business would look at the value add for offering this perk, and potentially adjust accordingly. That’s what happened here. It simply wasn’t worth the cost/liability/time they were spending dealing with all of this, so they made a change.

Is it a bummer that I don’t get fees back in the rare cases I have to refund my customer? Of course! But logically, I cannot hate PayPal because of it, or consider it robbery. That’s just silly.

If it’s not an industry standard, then tell me who else is not keeping fees when they refund? Most of them not only keep the fees, but they actually charge you an additional fee for processing the refund.

Square is the only one I know of that still shows they will refund your fees if you refund a payment. However, look at their fees page and you’ll see they charge a higher fee in general for all “keyed” transactions, which would be every transaction that happens on your website. That’s not a very good trade. So again, it’s all about value here. I also would not be surprised at all to see them make this same change before long.

Then you mention eBay. Well, once again, I simply do not see how you can blame PayPal for an eBay problem..?? That makes zero sense. PayPal provides the Authorization and Capture functionality that would solve the “canceled order” problem one eBay 100%. eBay chooses NOT to implement this functionality for its sellers. That is not PayPal’s fault.

On that note, eBay has now switched to their own “Managed Payments” platform. Have you gotten switched over to this yet? If so, they’re using Adyen Payments as the processor for credit cards now. Adyen Payments on their own user agreement states that they also do NOT refund fees on refunds, and they actually do charge additional fees for processing the refund transaction itself.

However, as part of their agreement with eBay specifically, I have seen rumors that they WILL refund fees on eBay transactions that are refunded. I have not been able to confirm this or get verification from anybody, though. I’ve had this exact same conversation with many people, and none of them will ever follow through after I lay all of this out.

If you’re willing to do so, that would be great. I would love to verify that, and then you’ll know that you’ll get fees refunded on such payments on eBay. At least for now. Once Adyen starts running into the same problem that PayPal did, they’re going to make the same change. It may not be tomorrow, next week, or next year. But it will happen. Just depends on how quickly they grow to 400+ million accounts like PayPal has, and how much of that bogus volume is getting moved through their system for their board members to start reviewing it the same way, and end up making the same decisions.

My guess is that based on their new partnership, they would tell eBay to get their $h1t together and implement a proper Auth and Capture workflow on their platform.

Any idea for a not-for-profit whose membership to our winter sports association hinges on Covid-19 and whether kids are safe crossing state lines in a coach bus? I’m looking at $1600 minimum in PayPal fees if we have to cancel our ski season and refund everyone. I am really reluctant to have people sign up if I’m going to be out that money if I have to refund memberships due to Covid-19. We have used PayPal for years and I don’t want to switch, but I may be forced to if there is no viable solution. Paying for nothing is not an option.

There are a couple of ways you could handle that. How long until you know whether you’ll be able to charge them or not? You could run Authorizations for everybody, and then you can capture those within 29 Days. You don’t pay any fee until Capture, so if you end up canceling and Voiding all of the Authorizations, then there is no fee.

If it’s going to be more than 29 days, I would suggest you build your sign-up so that it creates a billing agreement (payment token) for that user. This way you can trigger a Reference Transaction in the future, which will use that token to trigger a payment in the amount you need whenever you need it. You’ll have to handle scenarios where the reference transaction payment fails, but again, no fee would be taken until you actually process a successful reference transaction.

This is the same thing you should be doing regardless of who you’re processing the payment with. On that note, the only one I know of that is still showing they will refund fees is Square. However, if you look at their rate structure, they charge a higher fee than PayPal for all “keyed” transactions, which would be everything on a website, of course. So then you’d be trading higher fees for everything in exchange for refunded fees in the (hopefully) rare instances that you have to refund. Not a good trade in my opinion.

One of the options I mentioned above should work very well and avoid any problems with fees.

All my transactions are done via eBay. You clearly state eBay does not allow Authorisation and capture. You point finger at eBay then how can you then justify that it is ok for Paypal to keep the fees when the person losing out is neither Paypal or eBay?

Your argument that who has built the servers etc, that is a nonsensical argument, as that was a capital purchase. For Paypal to start, it had to build its servers and payment system. It is like walking into a shop where it has the shop, shelves, display cabinets, and so forth.

They had to build that for customers to come into their shop in the first place!

Secondly whether customers come or not, the shop/PayPal still need to make payment for maintaining the shop/servers. They still have to pay rent, bills etc. A transaction can only take if there is a place for the transaction to occur. It is the service that Paypal is selling, it is not selling the usage of their servers or their cost, that is a cost they bear regardless. Just as a shop sells a shirt for example, that is the commodity that is being exchanged for money, not payment towards the upkeep of the shop.

Hi Shanni,

I understand your frustration, but let’s step through your comments.

First, PayPal provides the Authorization and Capture functionality. This is very clear in their developer documentation, and it’s also very clear in all payment processor docs. It’s a standard procedure.

People who build platforms with PayPal as a payment processor should follow the standard procedures. eBay did not. eBay built out this major platform and failed to provide this very simple, standard functionality. That is not PayPal’s fault.